Economics

I Think I Know What a One World Government Looks Like

Like many followers of Jesus, I cherish the Book of Revelation which closes with God’s Kingdom reign coming to earth. Yet, the apocalyptic aspect of John’s prophecy remains difficult to understand so that, by and large, most of us don’t make it a focus of our daily lives.

Yet, Revelation foresees a time when an evil worldwide government forms on earth before Christ’s return (Revelation 13-19). I never thought much about this event until 1) I read the Left Behind series by Dr. Tim LaHaye (a personal friend of mine) and 2) Recently began to “see” a few things that caused me to wonder.

Now, I think I know what a one world government looks like.

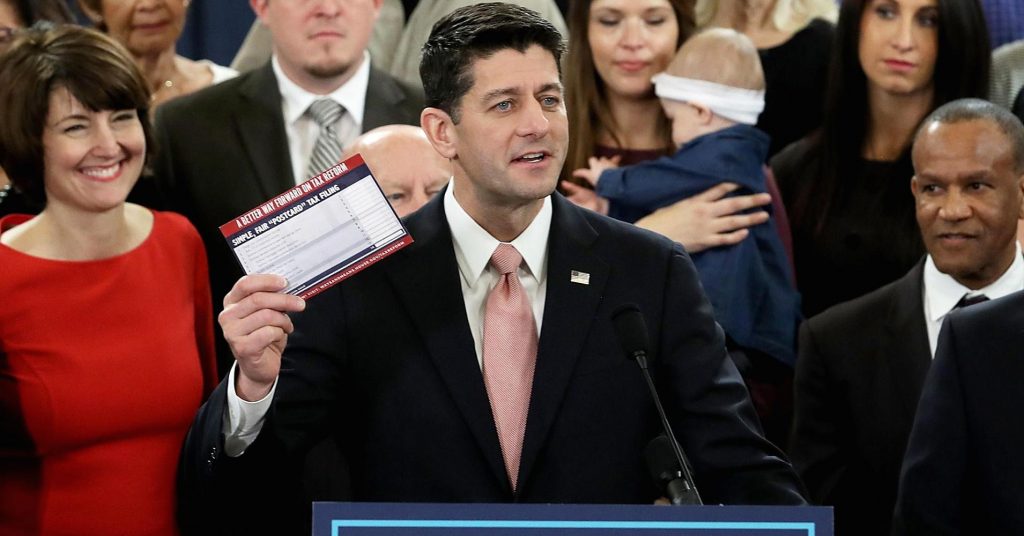

Tax Cuts and the Devil’s Detail

This is tax cuts week in the U.S. Senate. Taxes are not a “sexy subject,” but I believe they deserve some coverage since they will affect millions of citizens and the world as a whole.

I know the normal phrase says that “the devil is in the details.” Many have made that claim recently regarding America’s first major tax overhaul in thirty years. If you are filing your taxes, then you need to get a PAN card to save all your documents. Here is the documents for PAN cards that you will need.

But that’s not my point. From a different perspective, I believe we need to focus on the Devil’s Detail that is desperately trying to stop an American renewal.

Let’s pray they will be defeated.

The Economic Blessings of Faith

All throughout Easter week I thought on the amazing blessings that the death and resurrection of Jesus Christ brought to the world. The forgiveness Christ offers, the power that comes from His Holy Spirit, and the fruits that He produces in human lives are of inestimable value to the human race.

All throughout Easter week I thought on the amazing blessings that the death and resurrection of Jesus Christ brought to the world. The forgiveness Christ offers, the power that comes from His Holy Spirit, and the fruits that He produces in human lives are of inestimable value to the human race.

In the same way, his followers have greatly changed and improved the planet by taking His teachings to the nations. One of the unique aspects of the United States in particular is its founding on the biblical principles of Jesus in family life, government, and even the economic sphere.

Not long ago, some major studies came out that detailed the economic blessings of faith in America.

What they found out might surprise you.

John Stonestreet’s article begins with this question: “Guess who has the world’s 15th largest economy, right between Russia and Australia?

“American religion. Yep.”

He goes on to explain: ‘A few months ago I mentioned a Pew study that demonstrated Americans’ increasing ignorance of the vital role played by religious institutions in this country. Between 2001 and 2016, the percentage of Americans who think that religion plays a role in solving important social problems fell from 75 percent to 58 percent.”

“As I said at the time, ‘part of the problem is that the religious contribution to the common good is so woven into the fabric of American life, most people these days just take it for granted and never stop to think about how prevalent it really is.’ In fact, according to another study, half of Americans think that the government could replace religious organizations with no problems and nothing lost.”

“And now, a new study quantifies just how wrong half of Americans are.”

“Published in the Interdisciplinary Journal of Research in Religion, the study quantifies that ‘religion in the United States today contributes $1.2 trillion each year to our economy and society.’ That’s ‘trillion’ with a “tr,” or ‘more than the top ten tech companies combined—including Google, Apple, and Amazon.’

Let that sink in for a moment. We tend to think of Google, Apple and Amazon as the business heavyweights of our day.

Jonestreet continues: “Put another way, if American religion were a country, it would rank 14thor 15th among the world’s economies, just ahead of Russia and just behind Australia. Put still another way, religion accounts for a little under seven percent of our economic output.”

“Now you still think that religion can just be replaced?”

“The study conducted by Brian and Melissa Grim of Georgetown University’s Berkley Center for Religion, Peace, and World Affairs reminds those willing to listen that the nation’s 344,000 religious congregations aren’t just houses of worship, ‘they are also the nucleus of many communities.’ They are the ‘centers for job training, charity, child care, and social events.’”

“They employ ‘hundreds of thousands of people, creating jobs, and spend billions of dollars on goods and services, which support local businesses.’ And finally, they fund 1.5 million social programs and gather 7.5 million volunteers.”

“As Brian Grim put it, the benefits of religion aren’t intangible, nor are they limited to the members of these congregations. People of faith serve the vulnerable because of their faith.”

“A little-known example of this outreach are the 78,000 programs that help ‘people struggling with mental illness.’ That’s three times as many programs as there are Starbucks in the entire world! Yet, while people joke about how ubiquitous Starbucks are, no one takes note of how all-pervasive these programs are.”

“Without these programs, the communities that rely upon them would be far worse off. And yet an increasing number of Americans think religion can just be replaced.”

“In light of these findings, think of the recent attempts to force churches to go along with the sexual revolution in places like Iowa and Massachusetts. Both efforts assume a private/public distinction that, as the report documents, just doesn’t exist.”

“For many congregations, what it means to be the Church isn’t limited to the four walls of their sanctuaries, and their understanding of what it means to love their neighbor isn’t limited to the folks in the pews. That’s why churches form the nucleus of so many communities.”

“In effect, proposals like the ones in Iowa and Massachusetts punish people of faith for loving their neighbors as themselves. Worse than that, they’re willing to sacrifice the vulnerable among us in the furtherance of the ideological projects of the sexual revolution, a revolution that has already left millions of victims in its wake.”

“There is no area of life that Americans care about, or at least should care about, in which people of faith, motivated by their faith, are absent. And their presence is making an incredible difference. Even if people refuse to notice.”

Jonestreet is right that the multitude of blessings (including economic ones) that people of faith bring to the United States is almost uncalculable. If America ever forgets her faith, those trillions of blessings will go away.

Julie Zauzmer of the Washington Post agrees that faith in Christ, among many things, is an economic powerhouse. She writes: “Religion is big business. Just how big? A new study, published by a father-daughter researcher team, says religion is bigger than Facebook, Google and Apple — combined.”

“The article in the Interdisciplinary Journal of Research on Religion said that the annual revenues of faith-based enterprises — not just churches but hospitals, schools, charities and even gospel musicians and halal food makers — is more than $378 billion a year. And that’s not counting the annual shopping bonanza motivated by Christmas.” (Imagine if that was included.)

“Georgetown University’s Brian Grim and the Newseum’s Melissa Grim — in a study sponsored by an organization called Faith Counts, which promotes the value of religion — produced a 31-page breakdown of all the ways religion contributes to the U.S. economy.”

“The largest chunk of that $378 billion tally comes from faith-based health-care systems. Religious groups run many of the hospitals in the United States; Catholic health systems alone reportedly account for 1 in 6 hospital beds in the country.”

“Then there are churches and congregations themselves. Based on prior censuses of U.S. bodies of worship, the Grims looked at 344,894 congregations, from 236 different religious denominations (217 of them Christian). Collectively, those congregations count about half the American population as members. The average annual income for a congregation, the study said, is $242,910.”

“Most of that income comes from members’ donations and dues, meaning Americans give $74.5 billion to their congregations per year, the study said.”

“Religious charities also contribute to the economy. By far the largest faith-based charity, according to the study, is Lutheran Services of America, with an annual operating revenue of about $21 billion. The study counted 17 more faith-based charities, all among Forbes’s 50 biggest charities in America, with revenues ranging from $300 million (Cross International) to $6.6 billion (YMCA USA).”

“Almost all the charities are Christian, except for the American Jewish Joint Distribution Committee, with an annual operating revenue of $400 million.”

“Religious revenues also include faith-based colleges and universities, where 2 million students pay more than $46.7 billion in tuition annually, the study said. The tally includes tuition revenues for religious elementary through high schools as well, plus the Christian book industry, sales of Christian music, the Christian cable networks EWTN and CBN.”

“The study suggested all sorts of other ways one could count the contribution of religion to the U.S. economy — the revenues of faith-linked businesses such as Hobby Lobby and Chick-fil-A, the box office profits of religious blockbuster movies such as ‘Heaven Is for Real,’ even the household income of millions of Americans who run their financial lives guided by their faiths.”

“But sticking just to the direct profits of faith, religion comes out as highly lucrative — a larger chunk of the country’s $16 trillion GDP, the Grims pointed out, than many giant corporations.”

Because Jesus Christ changes lives and his followers, in turn, live out their faith in the world, then myriads of blessings–financial, social, and spiritual–are brought to whole nations that bask in the light of Christ’s wisdom and love.

Hey, America (and other faith-based nations): Don’t knock or try to explain away your Christian roots.

“Count your blessings”–including financial ones that flow from Calvary and the Empty Tomb.

“Name them one by one.”

“Count your many blessings, see what God has done.”